Taxpayer Dollars Wasted: New Audit Exposes Pritzker’s Major Failures in Undocumented Immigrant Healthcare

SPRINGFIELD – A new report from the Auditor General has revealed significant mismanagement in Governor JB Pritzker’s taxpayer-funded healthcare program for illegal immigrants, including thousands of potentially ineligible enrollees and costs far exceeding the Governor’s projections.

SPRINGFIELD – A new report from the Auditor General has revealed significant mismanagement in Governor JB Pritzker’s taxpayer-funded healthcare program for illegal immigrants, including thousands of potentially ineligible enrollees and costs far exceeding the Governor’s projections.

State Sen. Jil Tracy (R-Quincy) is calling for stronger oversight and accountability to prevent further waste and protect taxpayers.

Auditors found more than 6,000 enrollees listed as “undocumented” who actually had Social Security Numbers, raising concerns about the state’s failure to properly verify eligibility. This lack of oversight undermines public trust and forces taxpayers to cover the costs of the Administration’s mismanagement.

The audit also uncovered massive cost overruns, with some age groups seeing expenditures nearly 300% higher than originally projected. The most extreme overrun occurred in the 42-54 age group, where costs nearly tripled the budgeted amount. These budget failures highlight a significant lapse in fiscal planning, burdening Illinois taxpayers with the excess.

Republicans have long criticized Governor Pritzker’s decision to prioritize spending on illegal immigrants while Illinois families face rising property taxes, grocery bills, and healthcare costs. This program, marked by waste and mismanagement, has fueled further distrust in how taxpayer dollars are spent.

The audit’s findings have prompted renewed calls for legislative action to bring much-needed transparency so taxpayers can see where their money is going. Senate Bill 1699 would require detailed annual reports on all taxpayer-funded programs for migrants, including healthcare, housing, legal aid, and other services. These reports would provide transparency on expenditures, appropriations, recipients, and contracts, and would be made publicly available online.

Sen. Tracy is committed to fighting for reforms that prioritize fiscal responsibility, transparency, and accountability to protect Illinois taxpayers.

Senators Tracy, Harriss, and Rose Call for Action on Property Tax Relief

Senators Tracy, Harriss, and Rose Call for Action on Property Tax Relief

Sen. Tracy joined State Senators Erica Harriss (Glen Carbon) and Chapin Rose (Mahomet) Feb. 27 to talk about a top concern voiced by residents in their respective legislative districts — the need to act now to provide relief from skyrocketing property taxes.

The Senators noted that during his Feb. 19 Budget Address, Governor JB Pritzker proposed a record $55.4 billion spending plan — the largest in state history — but failed to mention property taxes.

At a Feb. 27 press conference in the Capitol, Senator Tracy and her colleagues discussed legislative solutions they have on the table that will provide property tax relief.

Senate Bill 2086 raises income eligibility for the Senior Citizens Assessment Freeze Homestead Exemption to $75,000 and ties future increases to inflation. Senate Bill 2093 makes the Illinois Property Tax Credit refundable, providing more financial relief to lower-income homeowners. Senate Bill 2246 limits how much the assessed value of a home can increases during reassessment years, capping it at the rate of inflation.

Click https://youtu.be/mZyQeYNhMxY for Sen. Tracy’s remarks.

Click https://youtu.be/BPoHpkhYm8o for the Feb. 27 press conference.

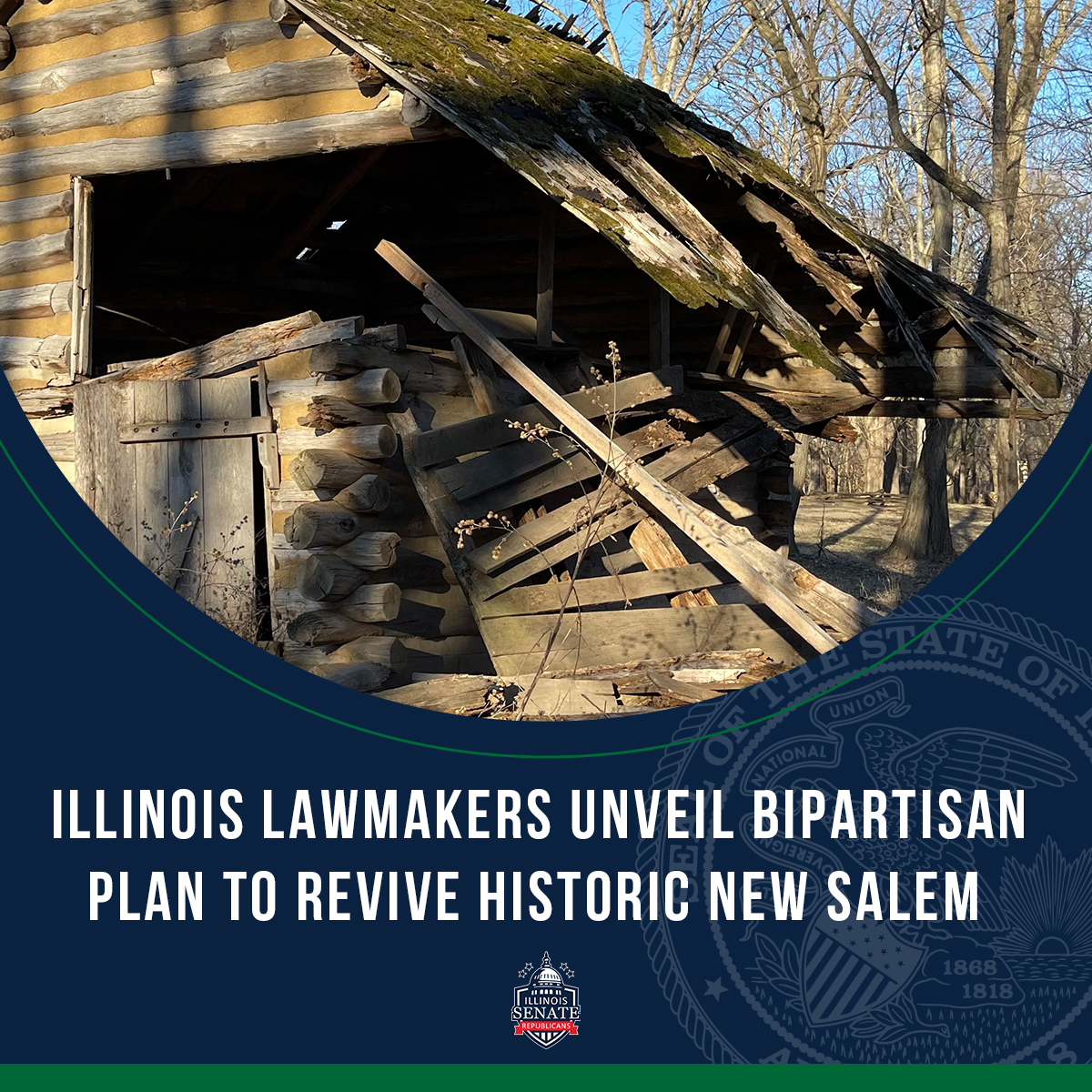

Illinois Lawmakers Unveil Bipartisan Plan to Revive Historic New Salem Site

Bipartisan legislation has been introduced to restore the New Salem State Historic Site, the former home of a young Abraham Lincoln, which is in urgent need of repairs.

Bipartisan legislation has been introduced to restore the New Salem State Historic Site, the former home of a young Abraham Lincoln, which is in urgent need of repairs.

The proposed legislative package includes:

- Senate Bill 1417 – Establishes the New Salem Preservation Commission to oversee site improvements.

- Senate Bill 1496 – Allocates $5 million in state funds for restoration efforts.

- Senate Bill 1861 – Exempts certain purchases related to the site from state procurement regulations.

Senate Bill 1417 has already passed the Senate State Government Committee, while the other two bills are awaiting hearings in the Senate Appropriations and Executive committees, respectively.

Local advocates, including the New Salem Lincoln League, are working alongside lawmakers to raise awareness and secure funding to preserve this key part of Lincoln’s legacy.

IDNR Announces Grants to Strengthen Rural Fire Departments

The Illinois Department of Natural Resources (IDNR) is accepting applications for Volunteer Fire Assistance (VFA) grants from NOW to April 14. These grants help rural fire departments organize, train, and equip their teams to better combat fires, particularly in areas at risk of wildfires.

The Illinois Department of Natural Resources (IDNR) is accepting applications for Volunteer Fire Assistance (VFA) grants from NOW to April 14. These grants help rural fire departments organize, train, and equip their teams to better combat fires, particularly in areas at risk of wildfires.

Administered by the U.S. Department of Agriculture Forest Service, the VFA program provides matching funds, covering up to 50% of project costs, with a maximum reimbursement of $10,000. Fire departments must make initial payments before receiving reimbursement.

In 2024, the program awarded $212,811 to support 30 Illinois projects, funding equipment like radios, hoses, protective gear, and chainsaws.

IDNR encourages all eligible fire departments to apply to strengthen their fire protection capabilities. Additional information about grant requirements and opportunities can be found on the IDNR grants website and the Illinois Catalog of State Financial Assistance.